Huge Price Increases Underway from Lamp Manufacturers: The impact of rare earth metals shortages

Source1:  “>http://www.renewableenergyworld.com/

“>http://www.renewableenergyworld.com/

Source2: http://www.connexiones.com

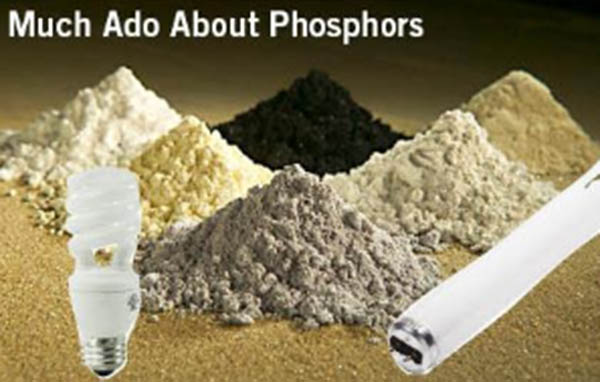

There is a rapid, emerging shortage of rare earth metals, a primary component used in the manufacture of fluorescent lamps – principally phosphors. Phosphors are transition metal compounds or rare earth compounds of various types. The most common uses of phosphors are prevalent in green technologies such as batteries, magnets, computer hard drives, TV screens, smart phones, and energy-saving light sources – and fluorescent lamps.

Will the rare earth minerals market be headed for a more normal supply condition following a World Trade Organization (WTO) ruling against Chinese export restrictions and the recent discovery by Japanese scientists? This indeed may be the case but unfortunately the damage has already been done. Our industry is now bracing itself for record price increases on fluorescent lamps due to the controlled export of phosphors, a subgroup of these rare earth elements.

The problem with the supply of rare earth elements is that demand has skyrocketed over the last decade from 40,000 tons to 120,000 tons. Meanwhile, China, who owns the monopoly of rare earth minerals has been cutting its exports. Today, it only exports about 30,000 tons a year – only one-fourth of the world’s demand.

Washington bureaucrats may finally be recognizing the severity of the situation. Last September, the U.S. Congress passed the Rare Earths and Critical Materials Revitalization Act.

The purpose of the law is to promote research and development into technologies that can replace REEs, as well as support the revival of REE production here in the United States. Additional legislation is reportedly also pending in both the House and Senate. Too little too late?

In a U.S. Department of Energy report dated December 14, 2010, it was noted that “it is likely to take 15 years for the U.S. to mine enough rare earth minerals to shake its dependence on China.”

With China currently  controlling up to 97% of the world supply of rare earth metals, it shouldn’t come as a surprise that they’ve been imposing tariffs and severe export restrictions.

controlling up to 97% of the world supply of rare earth metals, it shouldn’t come as a surprise that they’ve been imposing tariffs and severe export restrictions.

China first imposed trade limits in 1999, and its exports shrank by 20 percent from 2005 to 2009. Then a dramatic cutback in 2010, squeezing global supplies amid a dispute with Japan*, and they’ve fallen even further in 2011. China claims they’re just being frugal for environmental reasons, not economic leverage, but the cutbacks have nonetheless caused major price spikes – a condition our electrical and lighting industries are now having to deal with.